Malaysia’s house prices remained more or less steady, as the positive impact of strong demand is being offset by massive oversupply. During the year to Q3 2022, the nationwide house price index rose by a meager 0.72%, a slowdown from y-o-y increases of 2.62% in Q2 and 2.4% in Q1, based on figures released by the Valuation and Property Services Department (JPPH). Though when adjusted for inflation, house prices actually dropped 3.6%, its worst showing in recent history.

On a quarterly basis, the house price index fell by 2.11% (-2.79% inflation-adjusted) in Q3 2022.

Malaysia’s average house price stood at MYR 438,967 (US$103,076) over the same period.

By property type:

- Terraced house average prices rose by 1.34% y-o-y to MYR 418,592 (US$98,291) in Q3 2022. Quarter-on-quarter, prices fell by 2.17%.

- High-rise residential properties’ average price rose slightly by 0.78% y-o-y to MYR 342,506 (US$80,425) in Q3 2022. On a quarterly basis, prices dropped 1.54%.

- Detached house average prices were down by 3.01% y-o-y to MYR 617,432 (US$144,981) over the same period. Quarter-on-quarter, detached house prices fell by 1.68%.

- Semi-detached house average prices rose slightly by 1.16% y-o-y but dropped 2.93% q-o-q to MYR 669,402 (US$157,185) in Q3 2022.

Demand is robust. In Q3 2022, the total number of residential property transactions reached 64,989 units, up by 11.2% from the previous quarter and by a whopping 52.5% compared to the same period last year, according to the JPPH. Likewise, residential transaction value increased 10.4% q-o-q and by 40.4% y-o-y to MYR 25 billion (US$5.8 billion).

Though there remains a vast amount of unsold housing stock. In Q3 2022, residential overhang totalled 29,534 units worth MYR 19.95 billion (US$4.61 billion). Johor accounted for the biggest overhang, at 5,348 units, followed by Penang (with 5,222 units) and Klang Valley (with 4,386 units).

“Perhaps it is time to reduce new supply in the states of Johor and Penang to address this overhang in the years to come. More study and better assessment matrix need to be in place to determine actual demand before new supply enters the market,” said Chan Ai Cheng, president of MIEA.

Despite massive oversupply, residential construction activity remains high. During the first three quarters of 2022, the total number of housing starts for landed and high-rise residential buildings rose by 4.2% y-o-y to 72,993 units, while completions increased slightly by 0.5% y-o-y to 51,558 units in Q1-Q3 2022.

Malaysia’s housing market is expected to be buoyed by the government’s recent announcement of subsidies and incentives totaling MYR 55 billion (US$12.71 billion), in an effort to address worsening housing affordability. According to Sheldon Fernandez, country manager for PropertyGuru Malaysia, the programme will give first-time homebuyers up to 75% stamp duty discount on properties valued at MYR 500,000 (US$116,300) to MYR1 million (US$232,600) through the end of 2023.

“This will hopefully encourage homeownership among first-time homebuyers and further spur the property market,” said Fernandez.

The Malaysian economy expanded strongly by more than 7% during 2022, following a 3.1% growth in 2021 and a 5.5% contraction in 2020. It was the country’s best economic performance in more than a decade. The economy had grown by a healthy annual average of 5.3% from 2010 to 2019.

However, economic growth is projected to moderate this year, as global economic outlook remains gloomy and geopolitical conflict suppresses growth. The Finance Ministry forecasts a real GDP growth rate of between 4% and 5% this year, in line with the recent projections released by the International Monetary Fund (IMF) and World Bank.

House prices still below Asian crisis levels

Amazingly, house prices in Malaysia are still below pre-Asian Crisis 1997 levels, in inflation-adjusted terms, despite the recent housing boom.

Since the Asian crisis Kuala Lumpur’s house prices have significantly outperformed the rest of the country. After the downturn of 2008-2009 the property market was revitalized with the help of the Greater Kuala Lumpur Plan which included “The MRT Project”. From 2005 to 2015, Kuala Lumpur house prices surged by almost 122% (73% inflation-adjusted)

.

In contrast national price rises have been more muted. From 2005 to 2015, Malaysia’s house prices rose by 96.1% (52.4% inflation-adjusted).

From 2016 to 2018, nationwide house prices rose by an annual average of 5.2% (3.3% inflation-adjusted). However, the housing market has slowed in recent years, as the government’s market cooling measures took effect, coupled with the adverse impact of the Covid-19 pandemic. National house prices increased by just 2.3% from 2019 to Q3 2022, and actually dropped by 2.4% when adjusted for inflation.

Local house price variations

Kuala Lumpur has Malaysia’s most expensive housing, with an average price of MYR 741,445 (US$174,102) during the year to Q3 2022, followed by Selangor at MYR 501,085 (US$117,662), Sarawak at MYR 493,799 (US$115,951), Sabah at MYR 486,634 (US$114,269), Pulau Pinang at MYR 435,650 (US$102,297), and Johor at MYR 377,637 (US$88,675).

The cheapest housing in Malaysia can be found in Melaka, with an average price of just MYR 216,156 (US$50,756) and in Perlis, with an average price of MYR 223,000 (US$52,363).

House prices are also below MYR 300,000 (US$70,444) in Negeri Sembilan, Terengganu, Kedah, Pahang, Perak, and Kelantan.

Demand remains strong

Property demand remains fundamentally robust. In Q3 2022, the total number of residential property transactions reached 64,989 units, up by 11.2% from the previous quarter and by a whopping 52.5% compared to the same period last year, according to the JPPH. Likewise, residential transaction value increased 10.4% q-o-q and 40.4% y-o-y to MYR 25 billion (US$5.8 billion).

Perlis registered the biggest y-o-y rise in the total number of residential property transactions at a whopping 185.6% in Q3 2022, followed by Pahang (87.3%), Kedah (86.4%), Terengganu (83.5%), Negeri Sembilan (65.8%) and Selangor (60.4%). Strong increases were also seen in Pulau Pinang (56%), Melaka (54.1%), Johor (52.9%), Perak (43.2%), and Sabah (30.9%).

More modest increases in sales transactions were registered in Kelantan (23.6%), Sarawak (15.7%), WP Kuala Lumpur (14.5%), and WP Labuan (4.3%).

Only WP Putrajaya saw a y-o-y sales decline of 21.4% in Q3 2022.

Selangor dominated the market, accounting for about 24% of total residential property transactions in Malaysia in Q3 2022, followed by Perak with 12.6% market share and Johor, with 11.6% share.

In 2021, financial easing policies fuelled the property market, with the total number of residential property transactions in Malaysia rising by 3.9% to 198,812 units from a year earlier, in contrast to a 8.6% decline in 2020 due to the pandemic, according to JPPH. In terms of value, transactions increased strongly by 16.7% y-o-y to MYR 76.9 billion (US$18.06 billion) over the same period.

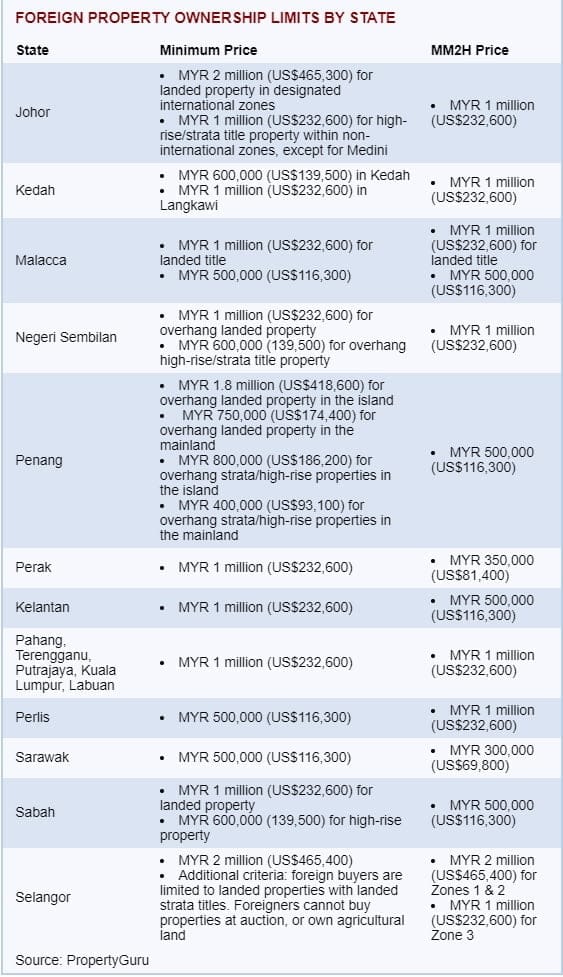

Foreign property ownership rules vary per state

The different states in the country vary on their criteria and investment threshold for foreign property ownership.

In Selangor, Malaysia’s most populous and largest state in terms of GDP, foreigners can purchase a property with a minimum value of MYR 2 million (US$ 465,300). However, foreign buyers are limited to landed properties with landed strata titles. In addition, foreigners cannot buy properties at auction, or own agricultural land in Selangor.

In Kuala Lumpur, as well as in Perak, Kelantan, Putrajaya, Labuan, Pahang and Terengganu, the minimum investment requirement is MYR 1 million (US$ 232,600), while it is only MYR 500,000 (US$116,300) in Perlis and Sarawak. Other states have different foreign property ownership limits too, as shown in table below.

The Malaysia My Second Home (MM2H) also serves as a special avenue for property purchase in the country. The MM2H scheme provides a renewable 10-year maximum, multiple-entry visa. Eligibility criteria vary between Peninsular Malaysia, Sarawak and Sabah. One of the benefits of MM2H visa holders includes discounts on the price of certain types of properties available on the market.

MM2H Scheme relaunched, stricter rules introduced

In January 2022, the “Malaysia My Second Home” (MM2H) scheme was relaunched under the Immigration Department, after it was temporarily suspended in July 2020, amidst the Covid-19 pandemic. Though, even prior to the pandemic, the programme had already been unofficially closed since September 2019, with claims of 90% application rejection rates.

However, the government announced new, stricter conditions for programme, including the requirement for applicants to have permanent savings of at least MYR 1 million (US$232,600) and a declaration of liquid assets of at least MYR 1.5 million (US$348,900).

Previously the savings required was just MYR 300,000 MYR 300,000 (US$69,800) to MYR 500,000 (US$116,300).

In addition, applicants must now have an offshore income of at least MYR40,000 (US$9,246) every month, sharply up from MYR10,000 (US$2,312).

Government charges were also increased sharply.

- The annual visa fee was raised from MYR90 (US$21) to MYR500 (US$116).

- There will be a processing fee charged by immigration of MYR5,000 (US$1,155) for principal applicants and MYR2,500 (US$578) for each dependent.

Applicants are also required to stay in the country for a minimum of 90 days annually.

“While the move to reactivate the MM2H is a good move, we are of the opinion that certain new requirements need to be revisited in order to stay on course of the purpose it was intended for,” said the Malaysian Institute of Estate Agents (MIEA).

“Malaysia is not the only country which has similar programmes, making it harder and will drive the new applicants away,” MIEA added.

From its inception in 20o2 to its relaunching last year, around 50,000 applications have been approved from 131 countries. China dominated the market, accounting for about 30% of all approvals, followed by Japan, Bangladesh, the UK and Korea.

The MM2H programme allows foreigners to live in Malaysia for a period of 10 years, provided that they meet the criteria. Successful applicants are also allowed to bring their spouse, an unmarried child under the age of 21, and parents who are over 60 years old.

Residential construction activity rising again, supply overhang remains large

Residential construction is rising modestly. During the first three quarters of 2022, the total number of housing starts for landed and high-rise residential buildings rose by 4.2% y-o-y to 72,993 units, following an annual growth of 5% in 2021 and declines of 18.6% in 2020, 17.3% in 2019 and 8.6% in 2018, according to JPPH. Likewise, completions increased slightly by 0.5% y-o-y to 51,558 units in Q1-Q3 2022, after falling in the past five years.

Yet there remains a vast amount of unsold housing stock. In Q3 2022, residential overhang totalled 29,534 units worth MYR 19.95 billion (US$4.61 billion). High-rise units accounted for 64.2% of the total overhang, while terraced houses had a 19.5% share.

Johor accounted for the biggest overhang, at 5,348 units, followed by Penang (with 5,222 units) and Klang Valley (with 4,386 units).

In the past four years, residential construction in Malaysia has weakened due to the government’s decision to freeze approvals for high-end property developments. Effective November 2017, the restriction covers properties costing over MYR 1 million (US$ 234,814). This was aggravated by the adverse impact of pandemic-related restrictions imposed in 2020 and 2021.

As a result, starts fell by an average of 10% annually from 2018 to 2021 while completions declined an average of 5% over the same period.

Key interest rates kept unchanged

In January 2023, the BNM’s Monetary Policy Committee (MPC) left its Overnight Policy Rate (OPR) unchanged at 2.75%, amidst expectations that the economy will slow this year. To tame inflation, the central bank hiked the key rate four times since May 2022, with a cumulative increase of 100 basis points.

“[Last month’s] decision allows the MPC to assess the impact of the cumulative past OPR adjustments, given the lag effects of monetary policy on the economy. At the current OPR level, the stance of monetary policy remains accommodative and supportive of economic growth,” said BNM.

The mortgage market continues to expand

The size of the mortgage market was about 44% of GDP in 2022, almost unchanged from the previous year but sharply up from 22% in 2008 and 13% in 1996, despite stricter lending guidelines in recent years and the Covid-19 pandemic.

In December 2022, housing loans outstanding rose by 6.9% y-o-y to MYR736.92 billion (US$170.23 billion), according to BNM. Over the same period:

- Commercial banks: housing loans outstanding increased by a modest 3.3% y-o-y to MYR470.29 billion (US$108.63 billion).

- Islamic banks: loans were up strongly by 14% y-o-y to MYR266.55 billion (US$61.57 billion).

- Investment banks: housing loans fell slightly by 0.3% y-o-y to MYR80.3 million (US$18.55 million).

However the rate of growth is slowing. The value of housing loans rose by an annual average of 8.5% from 2016 to 2022, down from annual average growth of 13.1% in 2007-2015 and 19.3% in 2000-2006.

Kuala Lumpur’s rental yields moderate; rents rising modestly

Gross rental yields from apartments in Malaysia remain moderate, ranging from 2.93% to 8%, according to a Global Property Guide research conducted in November 2022. The gross rental yield is the rent the landlord will earn – before taxation, vacancy costs, and other costs – compared to the property’s purchase price. While Malaysian property is often not particularly attractive in terms of return on investment, a stable country is a stable market. Residential property prices in Malaysia showed notable growth over the past 20 years.

Kuala Lumpur has an average gross rental yield of 4.41%.

As for other cities and areas in Malaysia, the rental yields are similar or slightly better than in Kuala Lumpur.

- In Johor Bahru the yields range between 4.15% and 7.28%;

- Petaling Jaya yields are between 3.74% and 4.88%;

- Georgetown yields fall between 2.93% to 4.37%;

- Shah Alam rental returns are 4.26% to 5.59%;

- Subang Jaya can yield between 4.04% to 5.87%;

- Iskander Puteri yields fall between 4.11% to 6.19%; and,

- Ipoh offers a rental yield of around 3.88% to 8.00%.

Rents are rising modestly. In Q2 2022, PropertyGuru’s rental price index for Malaysia increased 2.82% from the previous quarter and 4.46% from a year ago.

Malaysia has a small rental market. Only 6% of the housing stock is in the private rental sector. About 85% of total stock is owner-occupied, while government-provided housing accounts for 7% of the stock.

Strong economic growth, but outlook clouded

The Malaysian economy was estimated to have expanded by more than 7% during 2022, following a 3.1% growth in 2021 and a 5.5% contraction in 2020. It was the country’s best economic performance in more than a decade.

“[2022]´s economic performance is encouraging as a result of the reopening of the economy in line with a shift to a COVID-19 endemic phase,” said newly-sworn in prime minister Anwar Ibrahim.

The economy had grown by a healthy annual average of 5.3% from 2010 to 2019.

However, economic growth is projected to moderate this year, as global economic outlook remains gloomy and geopolitical conflict suppresses growth. The Finance Ministry forecasts a real GDP growth rate of between 4% and 5% this year, in line with the recent projections released by the International Monetary Fund (IMF) and World Bank.

“The government will do its best to strengthen economic indicators, restore investor confidence and rebuild a prosperous Malaysia,” Anwar added.

Labour market conditions are improving again. In November 2022, the unemployment rate stood at 3.6%, an improvement from 4.3% in the same period in the prior year, thanks to improved economic activity, according to figures released by the Department of Statistics Malaysia. The country’s jobless rate averaged 3.2% annually in 2009-19 before increasing to 4.5% in 2020 and 4.7% in 2021, mainly due to the Covid-19 pandemic.

The number of unemployed people fell by 1,100 people from the previous month, to 600,900 people in November 2022. Employment persistently increased since August 2021, with the number of employed rising by 27,100 people month-on-month to 16.11 million people in November 2022.

Inflation stood at 3.8% in December 2022, down from 4% in the previous month but still higher than the 3.2% seen a year ago, according to the Department of Statistics Malaysia. Malaysia’s inflation in 2021 was 2.5%, up from -1.1% in 2020, 0.7% in 2019 and 1% in 2018.

Fiscal position gradually improving

Malaysia’s budget deficit stood at about 5.8% of GDP in 2022, down from shortfalls of 6.4% in 2021 and 6.2% in 2020, based on government estimates. Though it remains far higher than the pre-pandemic deficits equivalent to 3.4% of GDP in 2019, 3.7% in 2018, 2.9% in 2017 and 3.1% in 2016.

Overall, the deficit is projected to fall further to 5.5% of GDP this year, in line with the government’s commitment towards consolidating the fiscal position for a more sustainable public finance.

Similarly, the primary deficit is expected to decline to 2.9% of GDP this year, from 3.3% in 2022, 3.9% in 2021 and 3.7% in 2020.

The Malaysian government’s shortfall soared to more than 6% of GDP during the onset of the Covid-19 pandemic in 2020-21 due to the introduction of several stimulus packages, with a combined value of MYR 380 billion (US$88.4 billion) – equivalent to almost 27% of the country’s GDP.

The government’s statutory debt is currently at about 61% of GDP. The statutory debt ceiling was raised from 55% to 60% in late August 2020, and then again from 60% to 65% in 2021, because of the need to undertake more borrowing during the pandemic. The increase of the ceiling to 60% was the first since July 2009.

The statutory debt is composed of Malaysian Government Securities, Malaysian Government Investment Issues and Malaysia Islamic Treasury Bills.

“The government’s debt is currently at RM1.5 trillion, including contingent liability, but the actual debt is at RM1.2 trillion, which is about 61 per cent of the GDP,” said Deputy Finance Minister Datuk Seri Ahmad Maslan.

Malaysian ringgit strengthens

The Malaysian ringgit is noticeably strengthening in recent months, as political condition improves following the appointment of Anwar as the new prime minister.

In January 2023, the ringgit gained about 8.6% of its value against the US dollar to reach an average exchange rate of MYR4.3188 = USD1 as compared to MYR4.6908 four months ago. This partly offsets the nearly 14% depreciation of the ringgit in the two years prior due to political tension, coupled with the adverse impact of the pandemic.

In Q3 2022, Malaysia recorded a current account surplus of MYR 14.14 billion (US$3.3 billion), sharply up from a surplus of MYR 4.4 billion (US$1 billion) but down from MYR 18.21 billion (US$4.2 billion) a year ago.

Political woes persist

In July 2018, former Prime Minister Najib Tun Razak was arrested over his role in the multi-billion dollar 1MDB corruption scandal.

Najib denied the allegations, and while in office, Malaysia’s authorities cleared him of all wrongdoing. But the case was reopened after the surprise defeat of the United Malays National Organisation (UMNO), which had governed Malaysia since independence, in the 2018 general elections. Mahathir Mohamad capitalized on public mistrust of Najib to win the general elections, vowing to bring his former protégé to justice. At least 42 charges were filed against Najib for alleged corruption, money laundering and abuse of power. He was then convicted and ordered to serve a 12-year prison sentence in August 2022, making him the first former Malaysian prime minister to be jailed.

A multi-party, multi-ethnic coalition called Pakatan Harapan (PH) was then formed. PH brought together in 2018 Anwar Ibrahim’s reformist Keadilan party, the main ethnic Chinese party, the DAP, and two anti-UMNO Malay parties, Amanah and Bersatu. Mahathir and Anwar agreed that if they won, the former would be prime minister but hand over to Anwar after two years, the exact process being left unclear.

A crisis over succession followed between the two leaders, who have a long history of unhappy relations. With growing tension within the coalition, Muhyiddin Yassin, another key HP leader, defected with more than 30 MPs to form an alliance with his old party, UMNO. In February 2020, Mahathir tendered his resignation, and the coalition collapsed. To avoid a political crisis, Malaysia’s constitutional monarch, King Abdullah, appointed Muhyiddin Yassin as the new Prime Minister, and an UMNO-led government was formed.

However seventeen months after taking office, Yassin’s government lost parliamentary support after UMNO’s president Ahmad Zahid Hamidi announced in July 2021 that UMNO is withdrawing its support for Yassin, citing his failed pandemic response. In August 2021, Yassin resigned after attempts to regain support from MPs were unsuccessful. He was replaced by Ismail Sabri Yaakob, who served as MP until November 2022. During his 15-month in office, he lifted the Movement Control Order following the expansion of the vaccination programme and oversaw the Twelfth Malaysia Plan.

The November 2022 general elections failed to achieve concluding results, as neither of the leading coalitions – Anwar’s Pakatan Harapan and Yassin’s Perikatan Nasional – have received a simple majority to form a government. The protracted election deadlock forced Malaysia’s king, the Yang di-Pertuan Agong, to make a decision on a new government and prime minister. On November 24, 2022, Anwar was sworn in as the tenth Malaysian PM. In December 2022, Anwar formed a unity government and appointed members of Parliament from Pakatan Harapan, Gabungan Parti Sarawak (GPS), and UMNO. The new PM has long been an advocate of Islamic democracy and for reforms to the country’s political system.

Source: Global Property Guide https://www.globalpropertyguide.com/Asia/Malaysia/Price-History